June Performance and July Outlook 2021

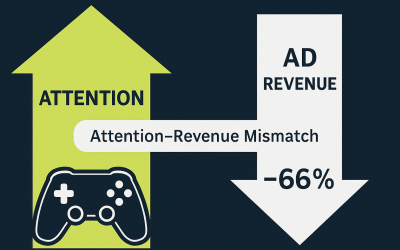

In this monthly series, we’ll review June’s performance for rewarded video ads in online games and provide insights for what developers can expect in July 2021. Rewarded video ads have become a powerful revenue source and engagement driver, with developers now monetizing over 90% of their player base by offering in-game rewards in exchange for ad views.

This trend is catching advertisers’ attention as well. In June, ad spend on in-game inventory increased by an impressive 40% compared to previous years. Let’s dive into the details of this three-year CPM and fill-rate trend and what it means for developers moving forward.

Contents

The Rise of Rewarded Video Ads: Monetizing More Users with Incentives

Continuing on June Performance and July Outlook 2021post, Rewarded video ads are unique in their dual role of increasing both revenue and engagement. By offering users in-game perks like extra lives or virtual currency for watching ads, game developers are seeing high participation rates. Unlike other ad formats, rewarded video ads actively engage users by aligning monetization with gameplay. As a result, they have become the go-to option for monetizing players who may not otherwise make in-app purchases.

For developers, this means they can generate revenue from a broad user base while keeping players happy and engaged. Additionally, advertisers see the appeal of in-game ads, especially when players willingly interact with these ads. The engagement data from June shows that the in-game ad market is growing rapidly, and rewarded ads are leading the way.

June 2021 CPM and Fill-Rate Trends by Market Tier

Analyzing the CPM (Cost per Mille) and fill-rate trends over the past three years highlights how rewarded video ads have evolved. CPM rates vary across market tiers, with Tier 1 markets commanding the highest rates. Here’s a look at the three-year trend for CPM and fill rates by market tier in June.

CPM Rates by Market Tier (June)

| Market Tier | June 2019 | June 2020 | June 2021 |

|---|---|---|---|

| First Tier Market | $3.24 | $3.58 | $6.39 |

| Second Tier Market | $1.96 | $1.44 | $2.65 |

| Third Tier Market | $0.79 | $0.81 | $0.89 |

- Tier 1 Markets: Tier 1 markets saw a massive 79% jump in CPM from $3.58 in 2020 to $6.39 in 2021. This spike shows that premium markets are prioritizing in-game ads more than ever, reflecting higher demand and ad spend.

- Tier 2 Markets: Second-tier markets also saw a substantial CPM increase, rising from $1.44 in 2020 to $2.65 in 2021, a strong indicator of advertisers’ interest beyond premium regions.

- Tier 3 Markets: While third-tier markets showed only a slight increase, with CPM moving from $0.81 to $0.89, even modest gains here highlight that in-game ads are gaining traction worldwide.

Fill-Rate Trends by Market Tier (June)

| Market Tier | June 2019 | June 2020 | June 2021 |

|---|---|---|---|

| First Tier Market | 69% | 74% | 89% |

| Second Tier Market | 54% | 55% | 61% |

| Third Tier Market | 41% | 43% | 41% |

- First-Tier Markets: Fill rates in first-tier markets rose sharply, reaching 89% in June 2021. This increase means that a greater share of ad requests was successfully filled, maximizing ad exposure and revenue potential.

- Second-Tier Markets: These markets saw a smaller but steady rise, with fill rates moving from 55% in 2020 to 61% in 2021. This growth aligns with the overall expansion of in-game advertising beyond the top markets.

- Third-Tier Markets: Fill rates in third-tier markets remained consistent at 41%. While demand hasn’t surged in these regions, steady fill rates suggest stable engagement levels and some potential for growth.

July 2021 Forecast: Projected CPM and Fill Rates

Continuing on June Performance and July Outlook 2021post, If trends hold, July 2021 will likely see further growth in CPM, projected to increase by about 7% overall. This rise aligns with the upward trend in ad spend and interest in in-game ad placements. Based on current performance, we expect fill rates to stabilize around 72%, ensuring consistent ad delivery and strong revenue opportunities for developers.

For developers, these forecasts are promising, particularly in Tier 1 and Tier 2 markets where CPM and fill rates are high. To maximize revenue, consider leveraging these insights by:

- Focusing on High-Performing Tiers: Target ad placements in Tier 1 and Tier 2 markets, where CPM rates and fill rates are most favorable.

- Optimizing Ad Placement and Timing: Place rewarded ads at strategic points in the game—like level breaks or game-overs—to enhance engagement.

- Balancing Rewards and Ad Views: Ensure in-game rewards align with user expectations so that players feel motivated to watch ads without becoming ad-fatigued.

How Developers Can Estimate Revenue Potential

If you’re a game developer interested in forecasting your potential earnings, understanding CPM and fill rates by market tier is crucial. By combining your game’s daily active user data with these rates, you can get a rough estimate of your ad revenue.

For a more precise calculation, reach out to us at info@blog.applixir.com. Our team can provide a tailored revenue estimate based on your game’s unique audience and engagement trends.

Conclusion: Rewarded Ads are Driving Growth in 2021

Continuing on June Performance and July Outlook 2021post, The growth in ad spend and engagement with rewarded video ads shows that this monetization model is here to stay. Developers are seeing record-high CPMs in key markets, while fill rates continue to strengthen across the board. By optimizing rewarded ad strategies, developers can tap into these trends and make the most of July’s projected increases.

Rewarded video ads are reshaping the in-game ad landscape, offering both high revenue and player satisfaction. As more advertisers recognize the value of in-game engagement, developers can expect even greater opportunities in the months to come.