Ad Monetization Trends Emerging in 2025:

The Rise of Mid-Tier Platforms, Creator Partnerships, and AI-Driven Personalization

The digital advertising landscape continues its dramatic evolution in 2025, building on the robust growth witnessed in 2024. According to the Interactive Advertising Bureau (IAB) and PwC’s latest research, digital ad revenues surged by 14.9% year-over-year to reach $258.6 billion in 2024—marking the highest growth rate since the post-pandemic period of 2021. This impressive rebound, more than doubling 2023’s modest 7.3% growth, signals a transformative period in digital advertising that extends well into 2025.

As we navigate this year’s ad monetization environment, several pivotal trends have emerged: mid-tier media companies are outpacing both larger and smaller competitors, video continues to dominate as the fastest-growing format, the creator economy is reshaping brand partnerships, and AI is moving beyond hype to deliver tangible value. Meanwhile, the deprecation of third-party cookies and increasing privacy regulations are accelerating the adoption of first-party data solutions, particularly retail media networks.

This blog post explores the key trends shaping ad monetization in 2025, examining how marketers, publishers, and platforms are navigating a landscape characterized by technological innovation, shifting consumer behaviors, and macroeconomic uncertainty.

Contents

- 1 The Rise of Mid-Tier Media Companies

- 2 Video Dominance and the CTV Revolution

- 3 The Evolution of Social Media Monetization

- 4 The Ascension of Retail Media Networks

- 5 The Transformation of Audio Advertising

- 6 AI’s Impact on Ad Monetization

- 7 Navigating Macroeconomic Uncertainty

- 8 AppLixir: Adapting to the New Ad Monetization Landscape

The Rise of Mid-Tier Media Companies

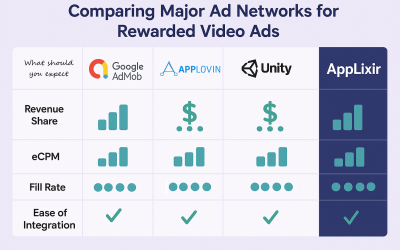

Starting with my Ad Monetization Trends Emerging in 2025 post, Perhaps the most significant shift in digital advertising’s power dynamics is the impressive growth of mid-tier media companies. According to the IAB, these companies—comprising media platforms, streaming services, interactive media providers, including Rewarded video Ad Platofms —experienced the largest share of growth in 2024, capturing 11% of the market. While the digital ecosystem remains dominated by walled gardens like Google, Meta, and Amazon, mid-tier companies are growing at a faster rate than both the industry giants and smaller players.

“These midsized companies are adopting new business models, encouraging creator engagement, and leveraging AI and data-driven insights to offer more personalized, cost-effective advertising solutions,” noted IAB CEO David Cohen. Their success stems from several competitive advantages:

-

Agility and Innovation

Mid-tier companies can pivot more quickly than industry giants, allowing them to adapt to market shifts and technological disruptions with greater speed. Many have embraced experimental ad formats, interactive experiences, and creator-centric business models that resonate with audiences seeking authentic engagement.

-

First-Party Data Advantages

As third-party cookies phase out, mid-tier companies with direct audience relationships are capitalizing on their first-party data. Streaming services like Hulu and Peacock, for instance, have built robust data infrastructures that enable precise audience targeting while maintaining privacy compliance—a growing priority for advertisers in 2025.

-

Cost-Effective Alternatives

With inflation and economic uncertainty affecting marketing budgets, mid-tier platforms often offer more competitive pricing than the walled gardens. This value proposition has attracted brands looking to diversify their ad spend while maximizing return on investment.

-

Strategic Positioning

Many mid-tier companies have carved out specialized niches, focusing on specific demographics or content categories that enable them to deliver high-quality, contextually relevant advertising experiences. This specialization creates differentiated value propositions that the giants cannot easily replicate.

The continued growth of mid-tier players represents a healthy diversification of the digital advertising ecosystem. For publishers and content creators, this trend opens new monetization avenues beyond the traditional walled gardens, while advertisers benefit from expanded options for reaching their target audiences.

Video Dominance and the CTV Revolution

Video advertising continues its meteoric rise, accounting for nearly 25% of the digital advertising market in 2024. This growth is primarily driven by the accelerating shift from linear television to connected TV (CTV) and streaming platforms.

-

Premium Content Migration

The migration of premium live sports content to streaming platforms has been a game-changer. Major sporting events that were once the exclusive domain of broadcast television are now available on platforms like Amazon Prime Video, Peacock, and Apple TV+. This shift has brought valuable audiences and advertising dollars to the streaming ecosystem.

-

Programmatic CTV Advancements

Technological innovations in programmatic CTV advertising have increased both efficiency and effectiveness. Advertisers can now leverage improved audience targeting, frequency capping across platforms, and detailed performance metrics. Self-serve platforms have democratized access to CTV inventory, allowing smaller brands to participate in what was previously an exclusive advertising channel.

-

“Skinny” Bundles and Ad-Supported Models

The proliferation of “skinny” bundles—affordable, curated streaming packages—has expanded the ad-supported content universe. As subscription fatigue sets in, consumers are increasingly accepting ad-supported tiers in exchange for lower subscription costs. This trend has created valuable new inventory for advertisers and revenue streams for content providers.

-

Interactive and Shoppable Video

Interactive video formats are gaining traction, particularly those that enable seamless gaming experiences. Shoppable videos, which allow viewers to purchase featured products without leaving the content experience, are bridging the gap between advertising and e-commerce, creating more direct monetization opportunities for content creators.

For publishers and platforms, video’s premium CPMs continue to make it the most lucrative format for monetization. The challenge lies in creating scalable video content strategies that can sustain advertiser demand while delivering engaging viewer experiences.

The Evolution of Social Media Monetization

Continuing on Ad Monetization Trends Emerging in 2025 post, Social media advertising saw remarkable growth in 2024, climbing 36.7% year-over-year to $88.7 billion and capturing 34.3% of the total digital advertising market. This surge reflects fundamental changes in how brands approach social platforms, moving beyond traditional interruption-based advertising to more integrated, community-oriented strategies.

-

Long-Term Creator Partnerships

The IAB expects brands to increasingly adopt long-term creator partnerships versus one-off campaigns—a prediction that has proven accurate in 2025. These sustained collaborations enable deeper audience connections and more authentic brand integrations. For creators, these partnerships provide reliable income streams and the ability to develop more sophisticated branded content.

-

Cross-Platform Creator Ecosystems

As creators expand their presence beyond single platforms, brands are following suit with multi-platform strategies. Rather than platform-specific campaigns, advertisers are developing creator-centric approaches that span multiple touchpoints, following audience attention across the digital landscape.

-

Community-Driven Commerce

Social commerce continues to evolve, with platforms enhancing their native shopping features and brands developing community-oriented selling strategies. User-generated content (UGC) plays an increasingly important role in driving purchase decisions, with brands harnessing customer advocacy as a powerful monetization engine.

-

Regulatory Uncertainty and Platform Diversification

The regulatory challenges facing major platforms like TikTok have accelerated brand diversification across social channels. While TikTok’s ban deadline has been extended by the Trump administration, the uncertainty has prompted advertisers to develop contingency plans and explore emerging platforms, creating new monetization opportunities across the social ecosystem.

For content creators and publishers, these trends underscore the importance of building platform-agnostic audience relationships. Those who can maintain consistent engagement across multiple channels are best positioned to capitalize on the evolving social media monetization landscape.

The Ascension of Retail Media Networks

The Ascension of Retail Media Networks

Retail media networks have emerged as one of the fastest-growing segments in digital advertising, with retailers leveraging their first-party customer data to create powerful advertising platforms. This trend, initially pioneered by Amazon, has expanded to include traditional retailers like Walmart, Target, and Kroger, as well as vertical-specific e-commerce players.

-

First-Party Data Advantages

As third-party cookies continue their phase-out, retail media networks offer a compelling alternative through their rich first-party customer data. This allows for precise targeting based on actual purchase behavior—a capability that traditional display advertising increasingly lacks.

-

Lower-Funnel Focus

In an uncertain economic environment, advertisers are prioritizing lower-funnel tactics that deliver measurable returns. Retail media excels in this area, providing direct attribution between ad exposure and purchase. This performance-oriented approach aligns perfectly with 2025’s emphasis on advertising efficiency and accountability.

-

Expanding Beyond Owned Properties

While retail media initially focused on advertising within retailers’ own digital properties, networks are increasingly extending their reach across the open web. This expansion creates new monetization opportunities for publishers who can integrate with retail media platforms, leveraging their targeting capabilities while maintaining their direct audience relationships.

-

Enhanced Measurement and Reporting

Advancements in retail media analytics are providing advertisers with unprecedented insight into campaign performance. Closed-loop measurement systems that track the full customer journey from ad exposure to purchase are becoming standard, raising expectations for attribution across all advertising channels.

For publishers, partnering with retail media networks represents both an opportunity and a challenge. While these partnerships can unlock premium CPMs and enhanced targeting capabilities, they also require careful consideration of data sharing agreements and potential disintermediation risks.

The Transformation of Audio Advertising

Audio advertising, particularly podcasting, saw remarkable growth in 2024, with podcast ad revenue increasing by 26.4% year-over-year. While still representing less than 1% of total digital ad spend, audio’s rapid expansion highlights its emerging role in the monetization ecosystem.

-

Programmatic Audio Advancements

Programmatic technology is transforming audio advertising, bringing greater efficiency and targeting precision to podcast and streaming audio inventory. Dynamic ad insertion now enables contextual targeting and improved measurement, addressing previous limitations in the audio advertising space.

-

Voice-Activated Commerce

The proliferation of smart speakers and voice assistants is creating new monetization opportunities through voice-activated commerce. Brands are developing voice-optimized shopping experiences that enable seamless purchasing through audio interactions, particularly for repeat purchases and subscription products.

-

Audio Content Diversification

The audio landscape continues to diversify beyond traditional podcasts to include short-form audio content, live audio rooms, and interactive audio experiences. This expansion creates new advertising formats and monetization models, particularly for creators who can leverage their existing audiences across multiple audio touchpoints.

-

Local and Small Business Adoption

Improved self-serve platforms and reduced minimum spend requirements are making audio advertising more accessible to local businesses and SMEs. This democratization is expanding the advertiser base and creating new revenue opportunities for audio publishers of all sizes.

For content creators and publishers, audio’s continued growth highlights the importance of developing comprehensive cross-media strategies that leverage audio’s unique engagement qualities alongside other formats.

AI’s Impact on Ad Monetization

Artificial intelligence has moved beyond its hype phase to deliver meaningful improvements in campaign management, personalization, and advertising effectiveness. As the IAB notes, AI is now automating key aspects of the advertising workflow, creating efficiencies and unlocking new capabilities.

-

Creative Optimization at Scale

Generative AI tools are enabling advertisers to produce and test multiple creative variations at unprecedented scale. This capability is particularly valuable in video advertising, where production costs have traditionally limited testing opportunities. For publishers, AI-optimized creative can significantly improve engagement and effectiveness, driving higher CPMs.

-

Dynamic Personalization

AI-powered personalization engines are delivering increasingly sophisticated ad experiences tailored to individual user preferences and behaviors. These systems go beyond basic demographic targeting to incorporate contextual signals, sentiment analysis, and predictive modeling, creating more relevant and effective advertising.

-

Campaign Automation and Optimization

Automation tools are streamlining campaign management processes, from media planning and buying to optimization and reporting. These efficiencies are particularly valuable in an economic environment where marketing teams are expected to deliver more with constrained resources.

-

Enhanced Measurement and Attribution

AI models are improving multi-touch attribution, providing more accurate insights into the customer journey across channels and touchpoints. This enhanced measurement capability is critical as advertisers seek to understand the complex interactions between advertising exposures and consumer actions.

For publishers and platforms, embracing AI technologies is increasingly essential to remain competitive in the ad monetization space. Those who can leverage AI to enhance targeting precision, optimize yield, and demonstrate clear ROI will command premium prices in an increasingly performance-focused market.

The digital advertising landscape in 2025 is shaped not only by technological innovations but also by broader economic forces. The tariffs implemented by the Trump administration, ongoing inflation concerns, and global geopolitical tensions have created an environment where advertisers are approaching budgets with caution.

-

Performance-Focused Strategies

Economic uncertainty has accelerated the shift toward performance-based advertising models. Brands are prioritizing channels and formats that deliver measurable returns, with increased emphasis on conversion optimization, customer acquisition costs, and lifetime value calculations.

-

Budget Flexibility and Agility

Rather than committing to annual advertising plans, many brands are adopting more flexible budget allocation strategies that enable rapid reallocation based on performance and market conditions. This approach favors platforms and publishers that can demonstrate immediate impact and adapt quickly to changing advertiser needs.

-

Value-Driven Partnerships

Advertisers are seeking deeper, more strategic relationships with high-performing partners rather than spreading budgets across numerous channels. This consolidation benefits platforms and publishers that can deliver consistent results and strategic insights beyond basic inventory access.

-

Innovation Within Constraints

Despite budget pressures, advertisers continue to experiment with emerging formats and technologies, albeit with greater focus on those that offer efficiency advantages or unlock new audience segments. This selective innovation creates opportunities for publishers who can deliver novel yet proven solutions.

For content creators and publishers, navigating this economic environment requires demonstrating clear value through enhanced targeting capabilities, premium contextual environments, and measurable performance outcomes.

AppLixir: Adapting to the New Ad Monetization Landscape

As we progress through 2025, the digital advertising ecosystem continues to evolve at a rapid pace. The rise of mid-tier media companies, the dominance of video (particularly CTV), the transformation of social media monetization, and the increasing importance of first-party data all present both challenges and opportunities for stakeholders across the industry.

For publishers and content creators, success in this environment requires strategic adaptation on multiple fronts:

- Diversify Revenue Streams: Explore partnerships with emerging platforms and mid-tier media companies to reduce dependence on traditional walled gardens.

- Embrace Creator-Centric Models: Develop authentic, value-adding approaches to creator partnerships that foster long-term relationships rather than transactional engagements.

- Invest in First-Party Data: Build robust first-party data capabilities that enable targeted advertising while respecting user privacy and regulatory requirements.

- Leverage AI Strategically: Implement AI tools for content optimization, audience targeting, and yield management to improve monetization efficiency.

- Focus on Measurable Value: Enhance attribution capabilities to clearly demonstrate the ROI of advertising investments, particularly in uncertain economic conditions.

The digital advertising market’s strong performance in 2024 provides a solid foundation for continued growth, despite the absence of major cyclical events like the Olympics or elections in 2025. By embracing innovation, fostering strategic partnerships, and maintaining flexibility in the face of market changes, publishers and platforms can capitalize on the evolving ad monetization landscape and position themselves for sustainable success. AppLixir, a rewarded video ad platform for desktop and mobile web games.