Ad Mediations, Transparency and Solutions

In digital advertising, ad mediation helps app and game developers maximize revenue by connecting them with multiple ad networks. This process ensures each ad impression yields the highest return. However, as the industry grows, questions arise about the fairness and transparency of ad mediation platforms. This article examines the mechanics of ad mediation, its transparency, and its fairness to all stakeholders.

Contents [hide]

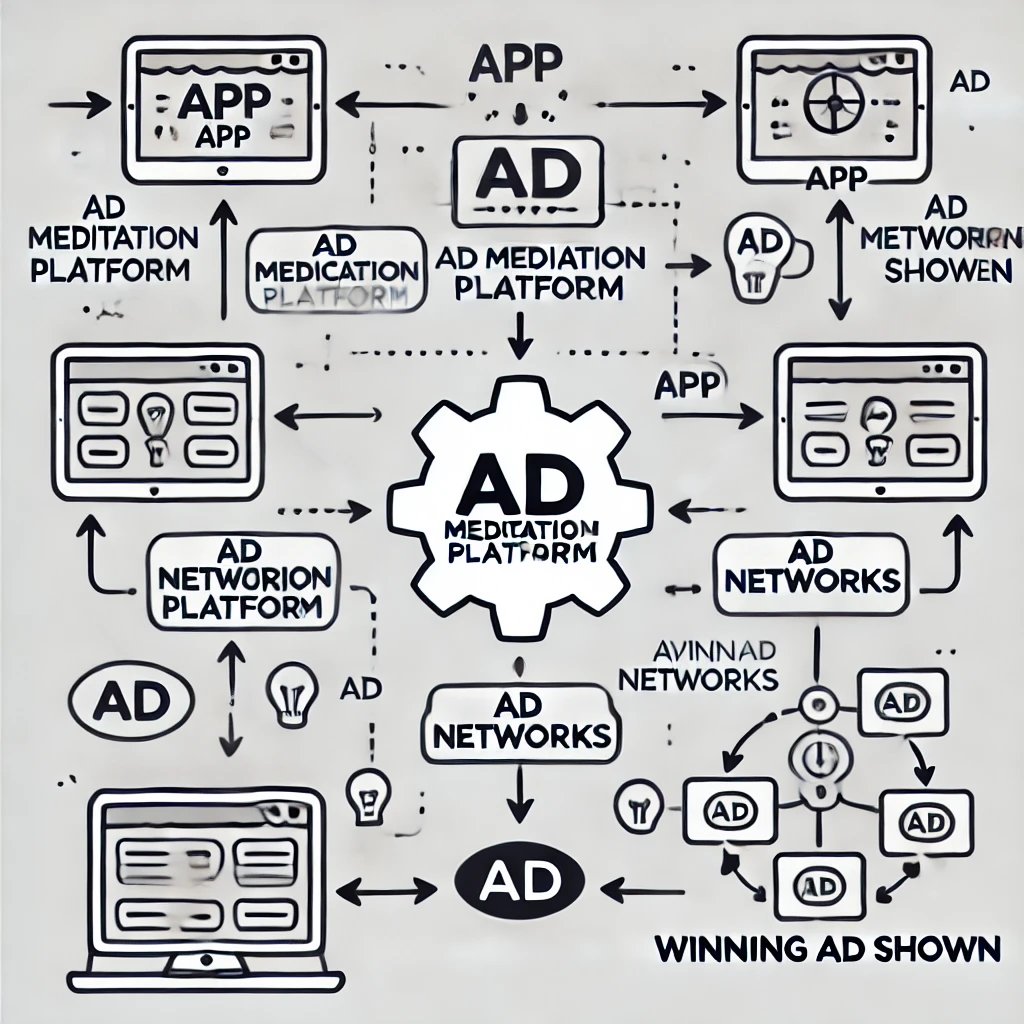

Understanding Ad Mediation

Ad mediation acts as an intermediary between app developers and various ad networks. Instead of integrating multiple ad networks individually, developers use a mediation platform to manage these connections. The goal is to optimize ad fill rates and eCPMs by allowing multiple networks to bid for each ad impression, fostering competition and increasing revenue.

How Ad Mediation Works

The ad mediation process involves several key steps:

- Ad Request Initiation: When a user interacts with an app and triggers an ad placement, the app sends an ad request to the mediation platform.

- Network Selection Process:

- Waterfall Model: Traditionally, mediation platforms used a waterfall approach, ranking ad networks based on historical eCPM data. The request cascades down this hierarchy until an ad is served.

- Real-Time Bidding (RTB): Modern platforms are shifting towards RTB, where all connected ad networks bid simultaneously in real-time for the impression, ensuring the highest bid wins.

- Ad Delivery: The selected ad network delivers the ad creative, which is then displayed to the user within the app.

- Revenue Attribution and Reporting: Post-impression, the mediation platform tracks performance, attributes revenue accordingly, and provides analytics to the developer.

The Shift from Waterfall to Real-Time Bidding

Following on Ad Mediations, Transparency and Solutions, the traditional waterfall model has faced criticism for inefficiencies and lack of transparency. In this setup, ad networks are called in a predetermined order, which doesn’t account for real-time fluctuations in demand and pricing. This can lead to suboptimal revenue generation, as higher-paying bids from lower-priority networks might be overlooked.

Recognizing these limitations, the industry is transitioning towards in-app bidding, a form of RTB. In this model, all demand sources bid simultaneously on each impression in a unified auction. This approach maximizes revenue by ensuring the highest bid wins and enhances transparency, as developers gain clearer insights into the bidding process and the true market value of their inventory.

Transparency Concerns in Ad Mediation

Despite the benefits of ad mediation, transparency remains a significant challenge. While mediation platforms promise developers the best possible revenue by optimizing ad placement and competition, the reality is often murkier. Several major concerns have been raised by developers and advertisers regarding how mediation platforms operate, including potential conflicts of interest, hidden fees, and opaque bidding mechanics.

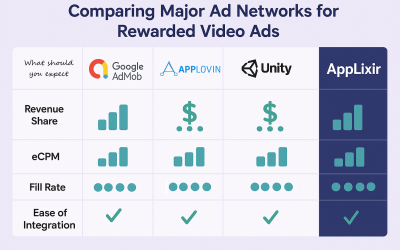

Preferential Treatment of Proprietary Networks

One of the biggest concerns surrounding mediation transparency is the potential conflict of interest when a mediation provider also owns an ad network. Major players like Google (AdMob), AppLovin (MAX), ironSource, and Unity LevelPlay operate their own demand-side platforms (DSPs) while simultaneously offering mediation services. This dual role raises a crucial question: Do these platforms prioritize their own ad networks over third-party bidders, even when it’s not the most profitable option for the developer?

Many developers have raised concerns that mediation platforms with proprietary ad networks give themselves an unfair advantage. While mediation should, in theory, select the highest-paying ad, these platforms might allocate premium ad inventory to their own network before calling on third-party demand sources. This means that even if an external ad network offers a higher bid, the mediation provider might still favor its own network, reducing overall competition and ultimately lowering the developer’s potential earnings.

A striking example of this concern came in 2023 when Meta’s Audience Network accused Google of prioritizing AdMob’s ads in its mediation stack. While Google denied these claims, such concerns continue to persist across the industry. Developers often lack the ability to audit these mediation platforms, making it difficult to confirm whether they are receiving the best possible revenue or if proprietary biases are at play.

Hidden Fees and Revenue Sharing

Following on Ad Mediations, Transparency and Solutions, another major concern is the lack of transparency in revenue-sharing models. While mediation platforms claim to facilitate fair competition among ad networks, many developers are unaware of the actual cut the mediation platform takes from ad transactions.

Some mediation platforms operate with a revenue-share model, where they take a portion of the ad earnings before passing the remaining revenue to the developer. The problem? Many platforms do not disclose how much they are keeping, leaving developers in the dark about their true earnings.

For example, if a mediation platform takes a 15% revenue share, a developer earning a $10 eCPM might only receive $8.50 without realizing where the remaining amount went. This hidden fee structure can add up to significant lost earnings over time, especially for high-traffic apps and games.

Some platforms have also been accused of taking an additional cut from advertiser bids. In traditional programmatic advertising, a demand-side platform (DSP) bids for an impression, and the highest bid is supposed to win. However, some mediation platforms intercept these bids and apply their own margins before passing them to developers, further reducing transparency.

To make matters worse, many mediation platforms bundle revenue reports in ways that obscure the true breakdown of earnings. Instead of providing granular data on which ad networks delivered the highest bids and how revenue was allocated, some platforms present developers with a single consolidated report, making it difficult to track performance accurately.

Opaque Auction Mechanics: The Black Box of Mediation

One of the most frustrating issues for developers is the lack of insight into how mediation auctions actually work. The auction algorithms used by mediation platforms are often proprietary and hidden behind black-box operations, making it impossible for developers to verify whether the system is truly selecting the highest-paying ad.

For instance, in a real-time bidding (RTB) system, all ad networks are supposed to bid simultaneously, with the highest bid winning. However, some mediation platforms still apply outdated waterfall logic, where ad networks are ranked based on past performance rather than real-time bids. This means that a lower-paying network could still get priority simply because of how the mediation platform structures its ranking system.

Additionally, developers rarely have full visibility into real-time bid values. Some mediation platforms only show estimated eCPM values, which are averaged across multiple bids. This prevents developers from seeing whether certain networks are consistently placing higher bids but not winning impressions. Without this transparency, it’s impossible to know if mediation is truly optimizing revenue or if certain networks are being favored unfairly.

Delayed Payouts and Reporting Discrepancies

Another common issue is the inconsistency in reporting and payment structures. Mediation platforms often work with multiple ad networks, each with its own reporting and payout schedules. This can create delays in revenue reporting and inconsistencies in earnings calculations, making it difficult for developers to track their actual earnings in real-time.

For example, some developers have reported that their mediation dashboards show significantly lower earnings than what individual ad networks report, raising concerns about potential revenue leakage within mediation platforms. Without clear breakdowns of where revenue is going, developers are left guessing about the true performance of their ads.

Striving for Fairness: Industry Responses

Following on Ad Mediations, Transparency and Solutions, as concerns over transparency grow, several industry players are working to address fairness in ad mediation by introducing new models, open-source solutions, and improved auction dynamics.

Open-Source Mediation Solutions

To combat the lack of transparency in mediation platforms, some companies are pioneering open-source mediation solutions. Platforms like Bidon provide fully transparent mediation layers, allowing developers to customize and audit the mediation process to ensure fair and unbiased ad selection.

By opening up the auction logic and bidding processes, open-source solutions eliminate hidden revenue shares and favoritism. Developers can verify exactly how bids are processed and confirm that the highest-paying bid always wins, rather than relying on black-box mediation algorithms.

Transparent Auction Dynamics

Some industry leaders are also working to enhance transparency in real-time bidding. Companies like Chartboost and PubMatic advocate for mediation models where developers have direct visibility into bid values, ad selection processes, and revenue attribution. By providing real-time auction data, these platforms ensure that developers can see whether mediation truly operates in their best interest.

Bidding-Only Mediation Models

To address concerns over preferential treatment, some mediation platforms are adopting bidding-only models that eliminate the waterfall system entirely. For example, adjoe’s WAVE mediation offers a fully transparent bidding environment where all demand sources bid simultaneously. This ensures that no ad network receives preferential treatment, and the highest bid always wins.

By removing manual priority rankings and historical eCPM weighting, bidding-only mediation models restore fairness to the auction process and give developers greater control over their ad monetization.

Navigating the complexities of ad mediation requires a proactive approach to ensure that developers are maximizing their ad revenue while maintaining fairness and transparency in the monetization process. Given the concerns surrounding opaque auction mechanics, hidden fees, and potential biases, developers must adopt a strategic framework to safeguard their earnings. Below are expanded best practices that developers can implement to make informed decisions and optimize their ad monetization efforts.

Best Practices for Developers

Diversify Mediation Platforms

Why It Matters: Using one mediation platform increases bias risk and limits revenue optimization. Some mediation providers favor their own ad networks. Without multiple platforms, developers can’t compare performance or identify higher-paying demand sources from alternative networks.

How to Implement:

- Integrate multiple mediation platforms (e.g., AppLovin MAX, Google AdMob Mediation, Unity LevelPlay, ironSource).

- A/B test different mediation setups to analyze revenue discrepancies.

- Compare eCPM rates, fill rates, and ad demand between platforms to identify potential bias.

- Monitor waterfall placements and bidding behavior to ensure fair competition across networks.

Demand Detailed Reporting

Why It Matters: Lack of granular reporting is one of the biggest transparency issues in ad mediation. Many platforms bundle revenue reports, making it difficult for developers to see how revenue is distributed, which ad networks are bidding the most, and whether the highest bids are truly winning. Without access to real-time bid-level data, developers cannot verify if they are getting the best deal.

How to Implement:

- Look for mediation platforms that provide bid-level transparency, showing real-time auction results.

- Request breakdowns of ad revenue by network, impression volume, and bid pricing.

- Analyze differences between estimated vs. actual eCPM rates reported by mediation platforms and ad networks.

- Regularly audit fill rates and bid rejection reasons to detect revenue loss due to unfair prioritization.

Analyze Revenue Trends & Performance Metrics

Why It Matters: A sudden drop in eCPM or lower-than-expected fill rates could indicate that a mediation platform is prioritizing certain demand sources over others, affecting revenue potential. Developers need to continuously track ad performance trends to detect irregularities and make necessary adjustments.

How to Implement:

- Compare eCPM performance across different mediation platforms.

- Track historical eCPM trends to identify seasonal fluctuations vs. potential mediation biases.

- Monitor bid win rates—if a high-bidding network is consistently losing auctions, it may signal an issue with auction transparency.

- Identify sudden changes in ad fill rates—low fill rates could mean that demand sources are being deprioritized.

Use Server-Side Bidding Solutions

Why It Matters: Many developers use client-side bidding, where auctions run within the app. Server-side bidding offers a fairer, more transparent process. Traditional waterfall mediation ranks networks by past performance. Server-side bidding lets all networks compete in real time, ensuring the highest bid wins.

How to Implement:

- Choose a bidding-first mediation platform like AppLovin MAX, Google AdMob Mediation, or ironSource LevelPlay.

- Implement hybrid mediation setups, where real-time bidding (RTB) is combined with a fallback waterfall to maximize revenue.

- Monitor bidding dynamics to ensure no network is receiving unfair priority.

- Optimize bidding floors and price thresholds to prevent underbidding.

Stay Informed About Industry Standards & Transparency Initiatives

Why It Matters: The ad monetization industry is constantly evolving, with new policies, technologies, and transparency initiatives shaping how mediation works. Developers who stay informed about industry standards can make smarter monetization decisions and avoid platforms that engage in unfair practices.

How to Implement:

- Follow industry leaders such as IAB Tech Lab, Google Ads Transparency Center, and OpenRTB Standards for updates on ad mediation policies.

- Join developer communities & forums (e.g., Unity Developers, IndieHackers, Mobile Dev Memo) to discuss mediation trends and revenue strategies.

- Regularly test new ad formats, demand sources, and monetization models to adapt to industry shifts.

- Keep an eye on regulatory changes (e.g., Apple’s ATT framework, GDPR, CCPA) that affect ad targeting and mediation compliance.

Final Thoughts: Mastering Ad Mediation Transparency

Before I finalize Ad Mediations, Transparency and Solutions post, Ad mediation boosts revenue but needs constant oversight to ensure fairness and transparency. Developers should diversify platforms, demand reports, and track trends. Using server-side bidding and staying informed helps maximize revenue while avoiding hidden pitfalls in mediation platforms.

As mediation evolves, developers must hold platforms accountable for fair auctions, transparent bidding, and unbiased revenue distribution. Successful monetization balances automation and transparency. Developers optimizing mediation strategies gain higher eCPMs, better fill rates, and sustainable revenue growth. Are you currently using mediation for your app or game? What challenges have you faced with transparency? Share your experiences in the comments below!